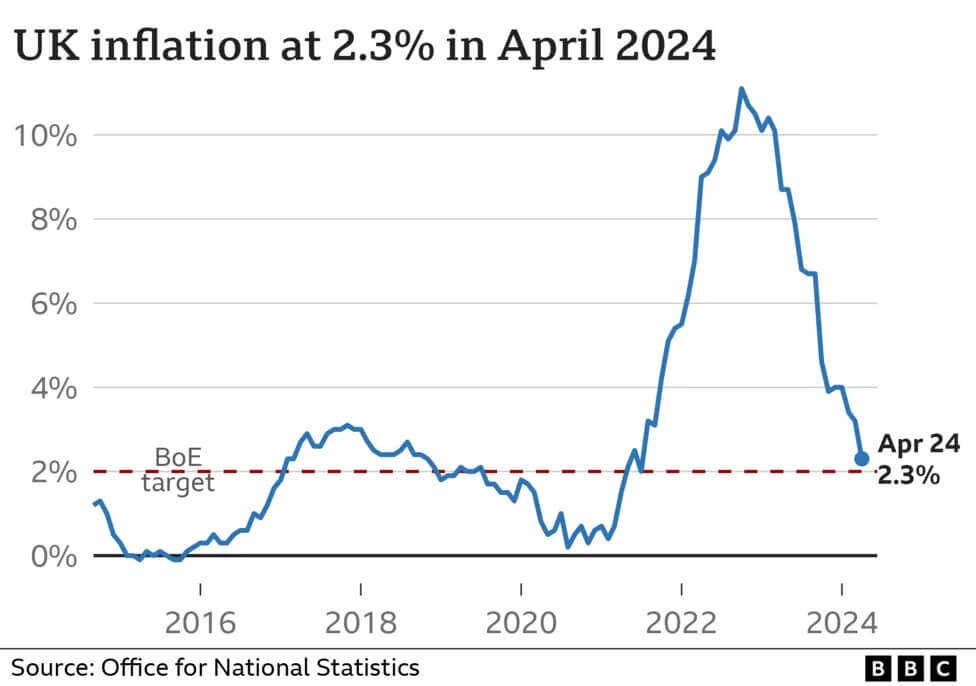

Prices rose at 2.3% in the year to April, down from 3.2% the month before, official figures show.

While inflation has fallen further, it remains higher than the Bank of England’s target of 2% and is still slightly higher than many experts were expecting.

The Bank has hinted that interest rates, which have been raised in recent years to slow price rises, could be cut this summer. Rates are currently at 5.25% – the highest level in 16 years.

Lower gas and electricity prices were the main driver behind the sharp inflation drop last month as a lower price cap, kicked in. Energy prices were 27% lower in April compared to 12 months before, with gas prices alone down 38%. Easing tobacco and food price rises also contributed to the inflation fall, but costs for mobile phone bills and rents continued to rise.

Sarah Coles, head of personal finance at Hargreaves Lansdown said for the average household, energy prices were still relatively high.

“It’s still a huge increase on the levels we saw before the invasion of Ukraine – when the cheapest deals cost around half this amount – but it’s a real shot in the arm for anyone trying to make ends meet,” she added.

Some foods, such as milk, butter, poultry and fish were cheaper in April than they were a year earlier, due to falling fertiliser prices and tougher negotiations from supermarkets on own-brand items, Ms Coles explained. But she said olive oil, cocoa and crisps were up because of disappointing harvests and high demand.

Prices for all goods – ranging from food to household appliances – decreased marginally by 0.8% in April compared to this time last year.

But services inflation, which measures price rises for things such as haircuts or train tickets, remained elevated at 5.9%. While soaring energy costs have been the main cause of the high cost of living in recent years, putting households and business under financial pressure.

Global as and oil prices soared following Russia’s invasion of Ukraine in February 2022. In the UK, the impact of the commodity price hikes saw inflation rise to 11% in October 2022 – its highest rate in 40 years.

The Bank of England said earlier this month that it expected inflation to fall “close” to its target level soon. However, it warned that it wanted to see “more evidence” before deciding to cut rates, which means August or September appear to be the most likely timing for a first cut, if inflation continues to fall as expected.

The interest rate set by the Bank dictates the rates set by High Street banks and money lenders. Higher rates mean people pay more to borrow money for things such as mortgages and loans, but savers also receive better returns.

While It feels like this should be a healthy dose of good news, but anyone with a mortgage may not be so enamoured to hear that it’s not as good as it seems, according to Ms Coles.

Rob Wood, chief UK economist at research consultancy Pantheon Macroeconomics, added that an August interest rate cut “looks much more likely than a June reduction after services inflation shockingly barely fell in April”.

Danni Hewson, head of financial analysis at AJ Bell, agreed, adding that the “expectation of a June rate cut has been washed away like confetti after rain-soaked summer wedding”. She said financial markets expectations of a rate cut next month had “plummeted from 50/50 to just over 10%”.

UK interest rates should be cut to 3.5% by the end of next year according to the International Monetary Fund (IMF) has recommended. The IMF said the UK’s economy was “approaching a soft landing” after last year’s mild recession. It upgraded its growth forecast marginally for this year from 0.5% to 0.7%, and predicted growth of 1.5% in 2025.

(Source: BBC)