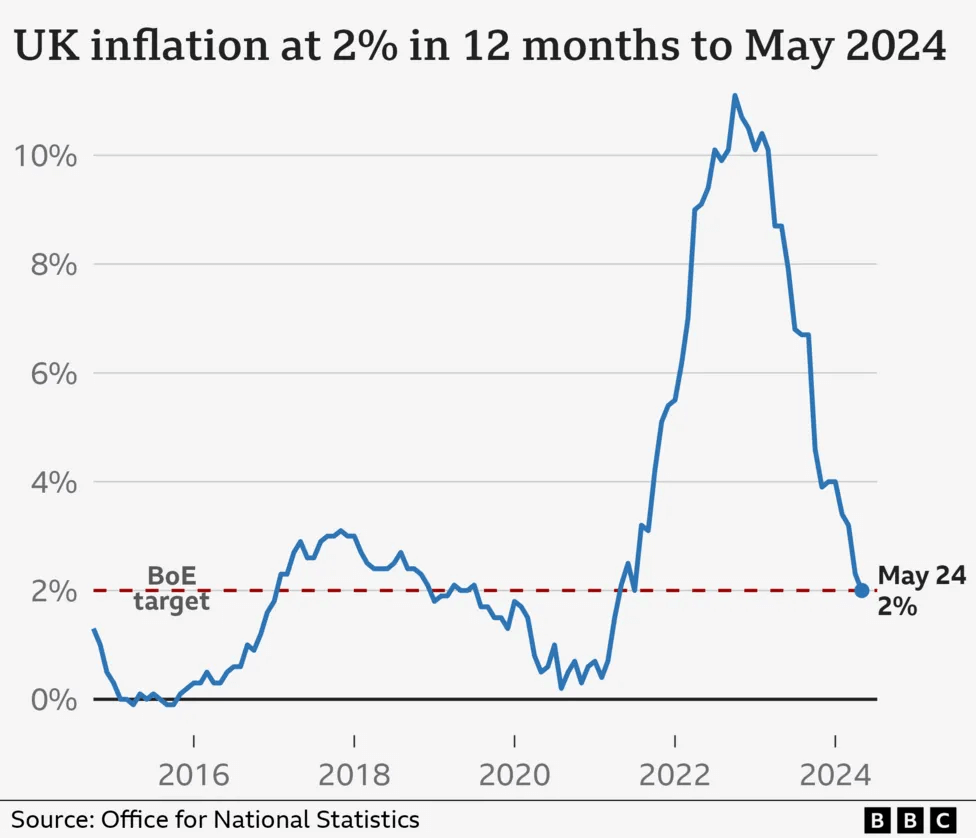

Prices rose at 2% in the year to May for the first time in nearly 3 years, down from 2.3% the month before, official figures show while the Monetary Policy Committee (MPC) keeps interest rates on hold, but opens the door for cutting rates in August.

The economy is a central talking point in the run-up to the general election on 4 July, with all of the main parties spelling out how they would keep the cost of living under control.

The drop in May’s inflation figure was driven by a fall in prices for food and soft drinks, and slower price rises for entertainment and culture and furniture and household goods. However, petrol prices are rising again, and food prices are still 25% higher than at the beginning of 2022.

The inflation figure came ahead of the Bank of England’s latest decision to keep on UK interest rates on hold. The bank held interest rates at 5.25% – a 16-year high – for the seventh meeting in a row.

Inflation has fallen steadily since October 2022, when Russia’s invasion of Ukraine caused it to peak at 11.1% as food and fuel prices soared, however, millions of households are still struggling with the cost of living.

Even though inflation is falling, it does not mean the prices of goods and services overall are coming down, just that they are rising at a slower pace. Meanwhile, even with the inflation rate falling, mortgage rates remain stubbornly high as lenders wait for the Bank of England’s next and subsequent moves on interest rates.

Gary Wildman, the owner of John Wildman & Sons butchers, told the BBC he had seen price rises levelling out at the store he started with his dad 31 years ago in Rustington, West Sussex. “Prices are probably 10 to 15% more than they were at the beginning of Covid, but they are level now, definitely,” and “you do take a hit to your margins,” he said. “You can’t pass all costs on to customers or the customers wouldn’t come in.”

May’s inflation figure is the last big official economic statistic before the general election and has sparked significant talking point among the main parties. The Conservatives claim the figures back up their story of an economic turnaround , although it is questionable whether they will get any credit for the fall.

Chancellor Jeremy Hunt said the UK’s inflation rate was now lower than “nearly all” major economies. “That would not have happened under Labour that refused to condemn the public sector pay strikes, that would have meant inflationary pay rises, inflation lasting longer,” he added. However, Labour continue to press concerns about an ongoing cost of living crisis.

UK inflation is now rising at its slowest pace since July 2021. It is also lower than in the eurozone and the US, where rates were 2.6% and 3.3% in May respectively. That being said, the UK is not out of the woods yet, with price rises in the services sector still high.

Rachel Reeves, Labour’s shadow chancellor, commented: “Unlike Conservative ministers, I’m not going to claim that everything is all fine, that the cost of living crisis is over, because I know that pressures on family finances are still acute”.

Yael Selfin, chief economist at KPMG UK, said services inflation was still “uncomfortably high” and the Bank would need to see a continued fall before cutting rates.

David Bharier, head of research at lobby group the British Chambers of Commerce, said May’s inflation figure provided “additional weight for an interest rate cut in the coming months”.

(Source: BBC)